georgia ad valorem tax motorcycle

We would like to show you a description here but the site wont allow us. According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes.

2021 Property Tax Bills Sent Out Cobb County Georgia

25 of the tag fees.

. Military members are exempt from assessment and property taxes upon registration renewal. 66 title ad valorem tax TAVT. Based on weight 12 minimum 5.

To take advantage of this exemption you must submit a current Leave and Earnings Statement LES in person with the AR OMV to confirm your active duty status. 200 annual alternative-fuel fee. This is the portion thats based on your cars value.

25 emissions inspection in Atlanta area. Annual ad valorem tax for vehicles purchased before 31213. Tax Exemptions for Military.

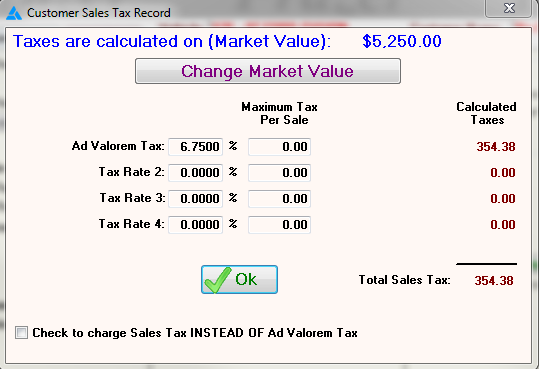

A 10 ad valorem tax due based on your vehicles value. 3 for new Georgia residents.

Tax Rates Gordon County Government

Vehicle Taxes Dekalb Tax Commissioner

Risultato Della Ricerca Immagini Di Google Per Http Www Uppitorino It Immagin Property Tax Georgia Properties Home Icon

How Much Are Tax Title And License Fees In Georgia Langdale Ford

Form Pt 471 Fillable Service Member S Affidavit For Exemption Of Ad Valorem Taxes For Motor Vehicles

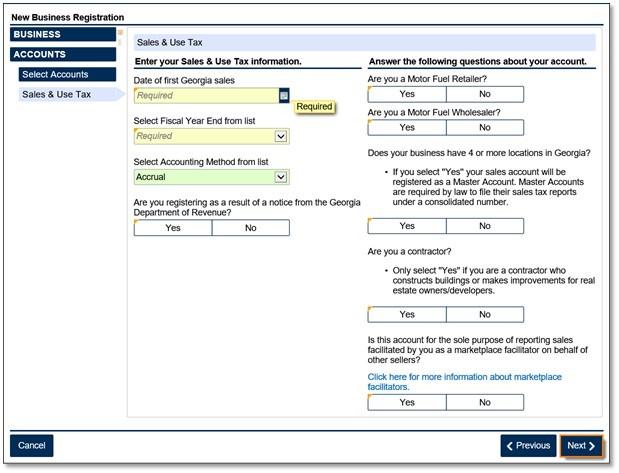

Marketplace Facilitators Georgia Department Of Revenue

What Are New Georgia Lease Laws Ga Car Dealership Near Me

Georgia Used Car Sales Tax Fees

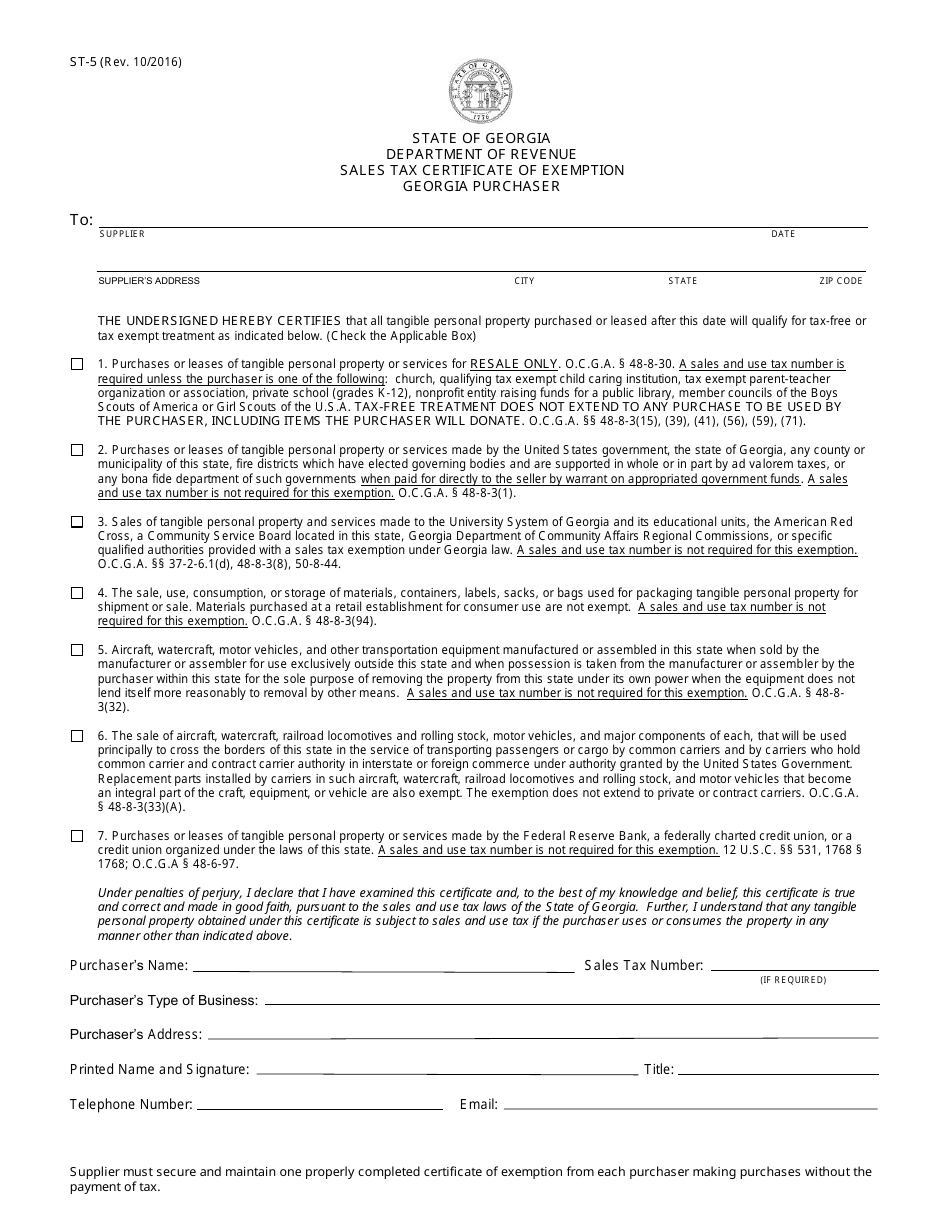

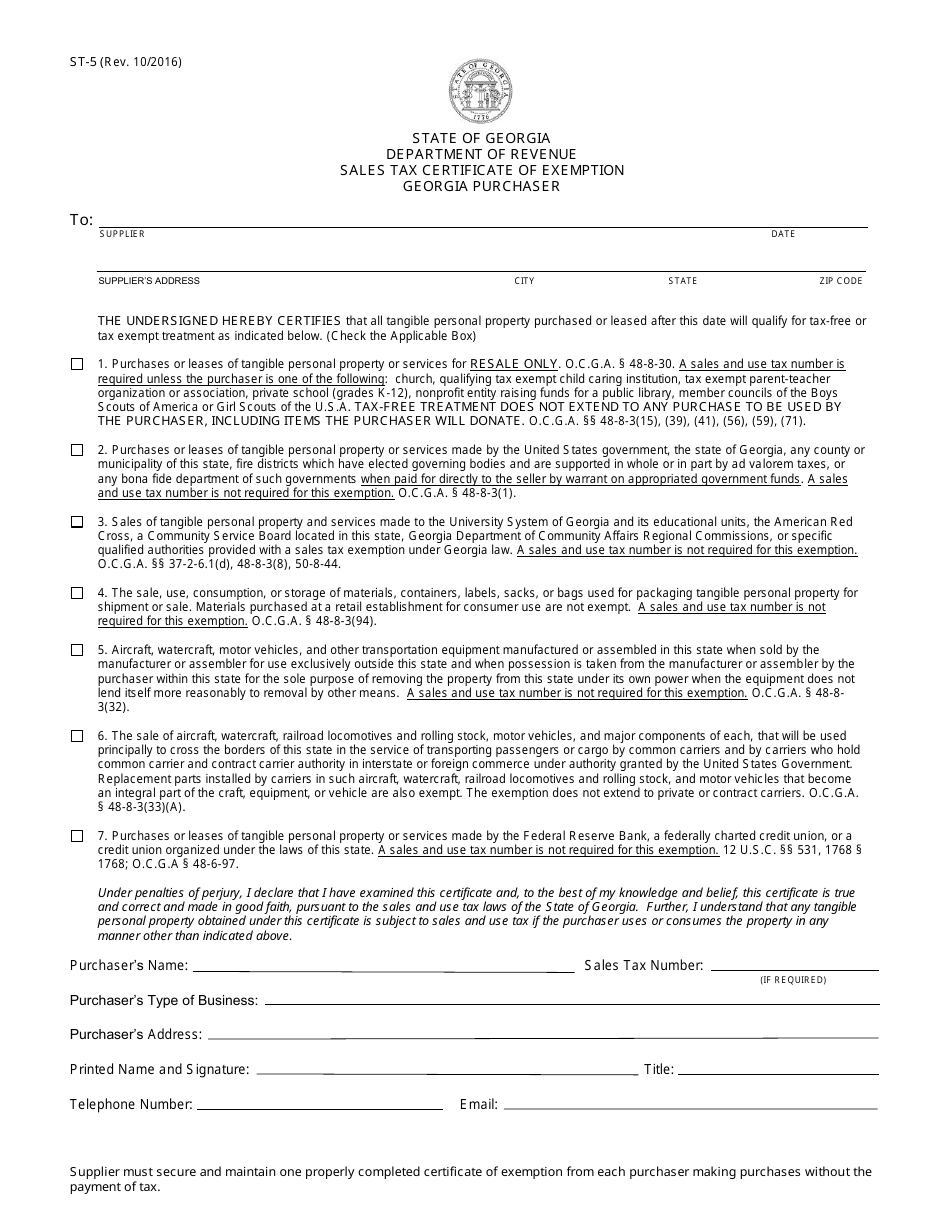

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Georgia Motor Vehicle Ad Valorem Assessment Manual

Frazer Software For The Used Car Dealer State Specific Information Georgia